The first Social Impact Bond (SIB) in Finland and the Nordic countries is now operational. The SIB aims to improve occupational well-being in the public sector. The first close investors are Sitra, Me-säätiö, and a private financial investor. The SIB is managed by Epiqus Oy. Grappling with a declining economic support ratio, Finland needs new solutions and innovations to deliver public services efficiently and effectively.

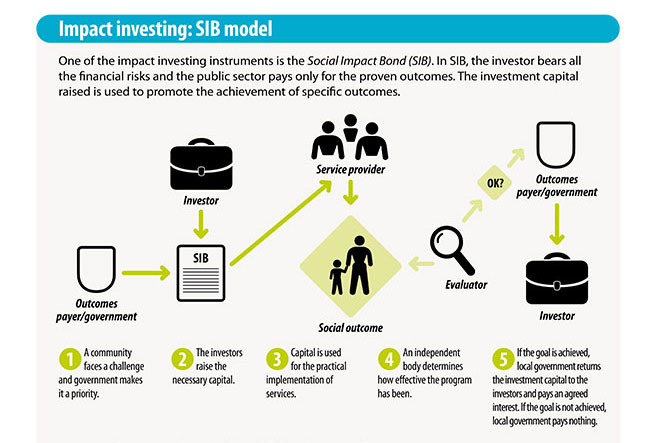

A Social Impact Bond (SIB) is a form of impact investing where investors finance and carry the risk of an intervention to improve social outcomes. The public sector commissioner pays only for the results.

Epiqus, a specialist fund manager dedicated to impact investment, has announced the first closing of the first SIB in Finland and the Nordic countries. The SIB has been implemented as a limited partnership fund, Epiqus Occupational Well-being. Anchoring investor commitments were provided by Sitra and Me-säätiö, complemented by a private financial investor.

Jussi Savukoski, Managing Partner at Epiqus, said: “The deteriorating economic support ratio in Finland has created some urgency among public sector commissioners to find ways of reaching important social mission goals without assuming financial or programme risk. Outcomes-linked financing is becoming an increasingly important tool.”

The proceeds will be invested in occupational well-being programmes provided to public sector employers in Finland over a three-year period. So far, co-operation has begun with Lounais-Suomen Maistraatti, Savon koulutuskuntayhtymä and Aleksia-liikelaitos (Nurmijärven kunta). The SIB initially covers 1,300 employees. The programmes are delivered by a panel of service providers initially consisting of Aino Health Management Oy, Tietotaito Group Oy, Trainers’ House Oyj and Headsted Oy.

Ulla Nord, the Managing Director of Me-säätiö, says they are involved in this SIB because they believe the model has wide applicability: “This project is a good example of a new and innovative way of improving well-being in our society. I hope that our example facilitates the creation of new SIBs, especially in the core areas of our mission: social exclusion among children, the young and families.”

Epiqus Occupational Well-being I continues to accept new clients and new investors. The minimum investment amount is 250,000 euros. Final closing is expected in the spring of 2016.

Private finance helping the public sector

The impact of this SIB is measured in the number of sick leave days. The goal is a reduction of 2.1 sick leave days per employee per year. If the goal is met, public sector participants will realise significant savings, part of which will be returned via the SIB to the investors.

Mika Pyykkö, Senior Lead, Impact Investing at Sitra, said: “Although the metric is sick leave days, this SIB targets material improvements in the occupational wellness and workplace well-being of the participants. This should become evident through quality-of-life improvements and more effective functioning of the employer organisation.”

The economic effect of sick leave in Finland is approximately 7 billion euros a year. Within the public sector, sick leave accounts for some five per cent of total work time, translating to approximately 2 billion euros a year. Due to variations in bookkeeping practices between the sectors, directly comparable figures are not available.

Sitra has been active in building an impact investment ecosystem in Finland for over a year now. It has worked on pilot SIBs with other partners, the most significant of which is the occupational well-being SIB that has been launched now. Sitra has decided to commit up to 1.5 million euros to Epiqus Occupational Well-being I as part of its own mission-related activity.

The SIB model originates from the UK. It facilitates the use of private capital particularly for preventive interventions that the public sector often struggles to finance adequately. The international applications of the model include foster care, recidivism and long-term unemployment. The occupational well-being focus of the first SIB in Finland is reportedly the first such application worldwide.

Epiqus Oy, the first regulated impact investment fund manager in the Nordic countries, manages capital to create measurable social and environmental impact alongside financial return. Epiqus dedicates 50% of its profits to social and environmental mission goals. Epiqus is AIFMD-registered (the Alternative Investment Fund Managers Directive), a member of the Global Impact Investing Network and signatory to the United Nations Principles of Responsible Investment. www.epiqus.com

Me-säätiö, a foundation endowed by Ilkka Paananen and Mikko Kodisoja, is dedicated to reducing social exclusion and inequality in Finland, particularly among children, young people and families. The foundation actively seeks new innovative financing solutions for the social interventions that are at the core of its mission. www.mesaatio.fi

The Finnish Innovation Fund Sitra is a future-oriented organisation that promotes Finland’s competitiveness and the well-being of the Finnish people. Sitra’s New working life and sustainable economy theme area promotes workplace renewal and economic sustainability through novel operating and financing models. https://staging.sitra.fi/en/economy/impact-investing

Contact:

- Jussi Nykänen, Chairman, Epiqus, +358 408 408 001, jussi.nykanen@epiqus.com

- Mika Pyykkö, Senior Lead, Impact Investing, Sitra, +358 294 618 259, mika.pyykko@sitra.fi

- Ulla Nord, Managing Director, Me-säätiö, +358 505 781 259, ulla.nord@mesaatio.fi

- Taru Keltanen, Specialist, Communications and Public Affairs, Sitra, +358 40 6743246, taru.keltanen@sitra.fi

Recommended