Foreword

Our economy and society depend on nature. Despite this, the degradation of nature and the services it provides continues, and action towards halting this negative trend does not meet the challenge. Current financial flows are also heavily tilted towards activities that harm nature instead of activities enhancing it. According to UNEP FI (2023), close to $7 trillion is invested globally each year in activities that have a direct negative impact on nature while only $200 billion is allocated towards nature-based solutions. Addressing biodiversity loss requires that nature-positive financing is nearly tripled by the end of the decade.

In 2022, 196 countries agreed to the Kunming-Montreal Global Biodiversity Framework (GBF), which provides a strategic plan to guide global efforts to halt and reverse biodiversity loss. As a part of the agreement (GBF Target 15), financial institutions and other businesses will need to disclose how their activities impact and depend on nature, acknowledging financial risks on inaction and opportunities to restoring nature. In September 2023, the Taskforce on Nature-related Financial Disclosures (TNFD) published their disclosure framework to address this.

In addition to the framework, TNFD also introduced the LEAP approach. The approach suggests using a Locate, Evaluate, Assess and Prepare (LEAP) process to assess nature-related dependencies, impacts, risks and opportunities. Assessing these exposures can drive financial institution action by demonstrating the materiality – including the financial materiality – of nature loss.

The Finnish Innovation Fund Sitra’s mission is to promote the well-being of Finland and accelerate economic growth within the limits of nature’s carrying capacity. In the fall of 2024, we organised a series of workshops to facilitate a better understanding of the LEAP approach and to empower individuals in financial institutions in Finland to utilise it.

The workshops provided a walkthrough of the tools and concepts needed in different phases of the LEAP approach and participation generated insights on how to start taking action. In addition, an action plan template was distributed to participants to ensure that lessons learnt are put into practice as soon as possible.

This report summarises the approach and reflections from these workshops. We hope the findings will empower further individuals in the financial sector, both in Finland and abroad, to start tracing the financial connection to nature and implementing meaningful actions to improve it.

9 December 2024

Outi Haanperä

Director, Sustainability Programme, Sitra

Summary

In 2024, the Finnish Innovation Fund Sitra, UK-based consulting firm The Biodiversity Consultancy and Finland-based consulting company Luontoa provided training on the TNFD-LEAP process to Finnish-based financial institutions. This paper summarises the core elements of this training, which aimed to accelerate the integration of nature into financial decision making – the ‘how to’ – rather than the ‘why’, the case for which is made in detail elsewhere, e.g. the Dasgupta Review on the Economics of Biodiversity.

The TNFD-LEAP process enables finance to understand its relationship with nature. The process involves locating (L) the interface of finance with nature, evaluating (E) the impact and dependency of finance on nature, assessing (A) the resultant risks and opportunities and preparing (P) a response.

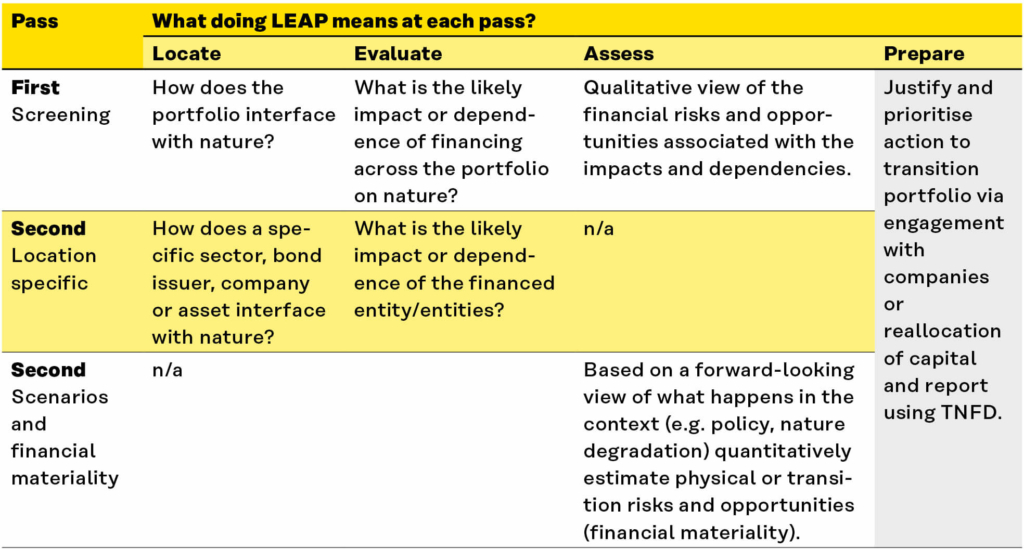

Financial institutions (FIs) face unique challenges applying the LEAP process. Their portfolios can cover thousands of companies, about which it is difficult to obtain location-specific information. This means FIs need to prioritise what location-specific data is gathered and why; and what to conduct nature-related risk and opportunity assessments upon. This process can be conceptualised as undertaking ‘multiple passes’ of the LEA of LEAP before preparing a response (the P stage). Under this ‘multiple passes’ approach:

- The first pass provides an initial, portfolio-wide indication of where nature-related impacts, dependencies, risks and opportunities may be greatest;

- The second and any subsequent passes quantitatively estimate the quantum and then financial materiality of nature-related impacts and dependencies.

Performing LEA iteratively enables FIs to prioritise the most material exposures and create a baseline of exposure that can be improved against over time with action and nature-related targets (P stage of LEAP). And a first pass of LEA also allows financial institutions to take meaningful first steps that can be used to prioritise where to engage and gather further data, without delay.

This paper outlines the ‘multiple passes’ approach to LEAP and provides an overview of the tools and techniques that can be used at different stages of the process. It then gives guidance on how financial institutions can use the insights they gain to develop policies and take meaningful action on nature.

1. From analysis to action: the use case of TNFD-LEAP

This section outlines the state of play for finance and nature, how the TNFD-LEAP process can support financial professionals to accelerate the integration of nature into financial decisions and how the ‘multiple passes’ approach to using LEAP can deliver action-useful insights.

Financial institutions are moving, on mass, to integrate nature into their allocation decisions and operating models. To show their commitment, 190 financial institutions with more than 20 trillion USD assets under management (AUM) have signed the Finance for Biodiversity Pledge.

However, “moving, on mass” typically means “starting, on mass”. The release of the TNFD recommendations in 2023 created both a method and a mandate for individuals to start integrating nature into their organisations’ operations, in addition to the pressure created by regimes such the EU’s Corporate Sustainability Reporting Direction (CSRD) and Sustainable Finance Disclosure Regulations (SFDR). At the time of publication, these individuals were usually creating a first nature vision for their organisation and trying to use limited data and internal knowledge to map the relationship between their finance and the natural world. Those organisations are beginning a journey that will involve (a) locating and baselining their nature-related impacts, dependencies, risks and opportunities; (b) prioritising exposures and setting targets to manage risk and grasp opportunity (c) disclosing progress; and (d) delivering those targets.

The LEAP process is an integrated framework developed by TNFD to help organisations identify, assess and act on material nature-related issues. The process involves locating (L) the interface of finance with nature, evaluating (E) the impact and dependency of finance on nature, assessing (A) the resultant risks and opportunities, and preparing (P) a response. See the Key Terms section at the end of this document for full definitions of the four stages of LEAP.

However, financial institutions must apply a unique approach to LEAP because of the volume and variety of exposures they have via the companies they finance. This unique approach is set out in this report, which features ’multiple passes’ of LEAP, wherein:

- The first pass is about screening for potential impacts and dependencies. The aim is to locate, evaluate and assess (L, E and A) the likely nature-related exposures at a portfolio level. This pass will be qualitative and indicative and lack location-specificity. It enables the prioritisation of sectors, countries and portfolio companies, based on the likely financial materiality, impact materiality and data availability.

- The second pass (and subsequent passes, as necessary) is about becoming increasingly location-specific, forward-looking and quantitative. This can baseline and justify increasingly ambitious financial institution targets and portfolio company transition engagement and planning (See Section 4.3).

See Table 1 below for more detail.

Table 1: The first two passes of LEAP

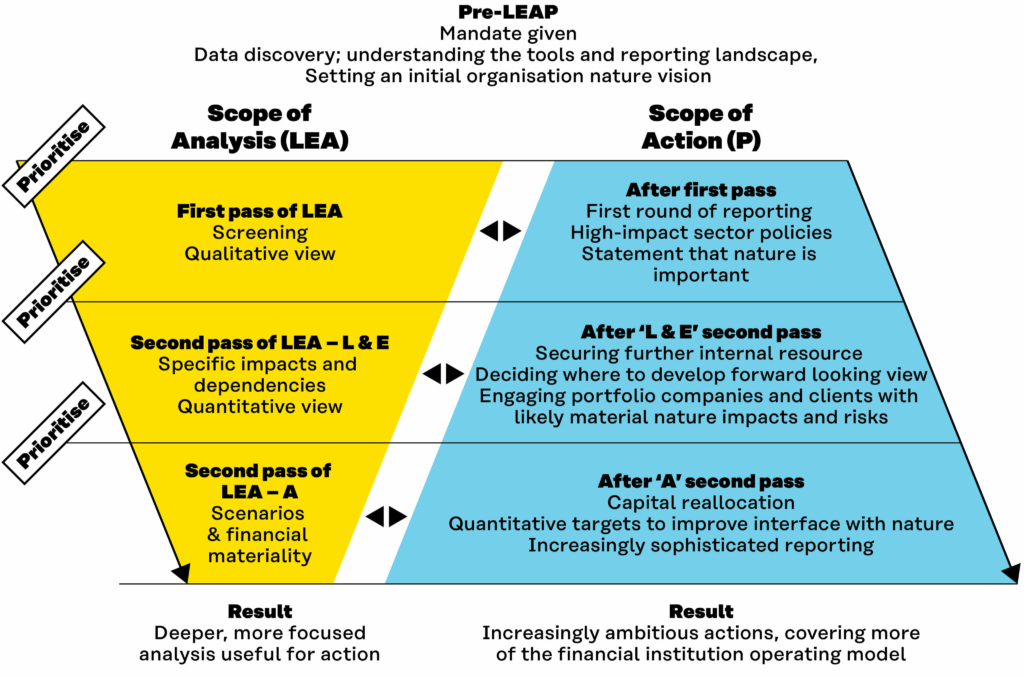

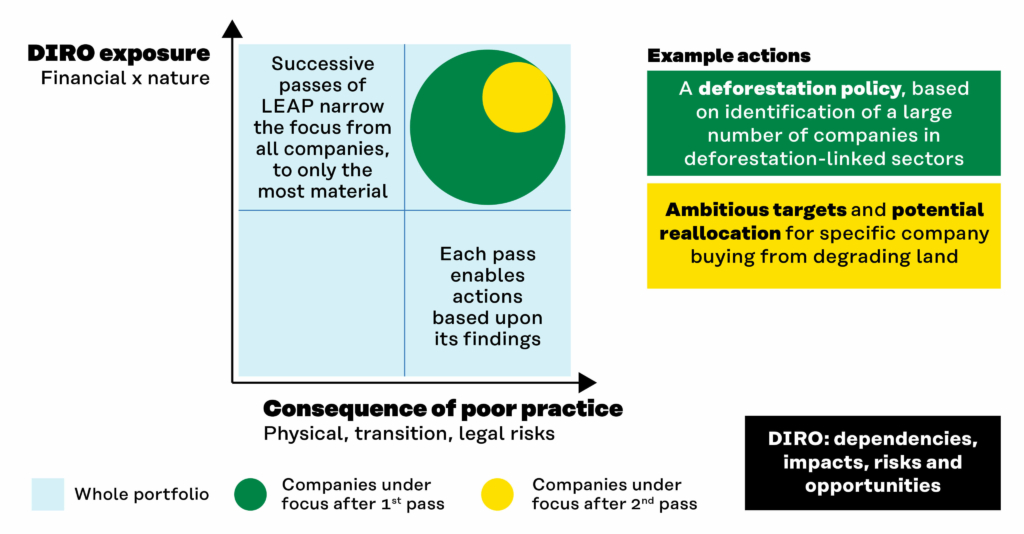

As LEA becomes more specific – focusing on locations, operations, and financial materiality – it becomes easier to justify ambitious and impactful action. Each stage deepens the analysis in priority areas, enabling a progressively broader scope of action (see Figure 1 below). However, the first pass allows financial institutions to start understanding their relationship with nature now to prioritise engagement where the impacts and risks are likely to be the greatest.

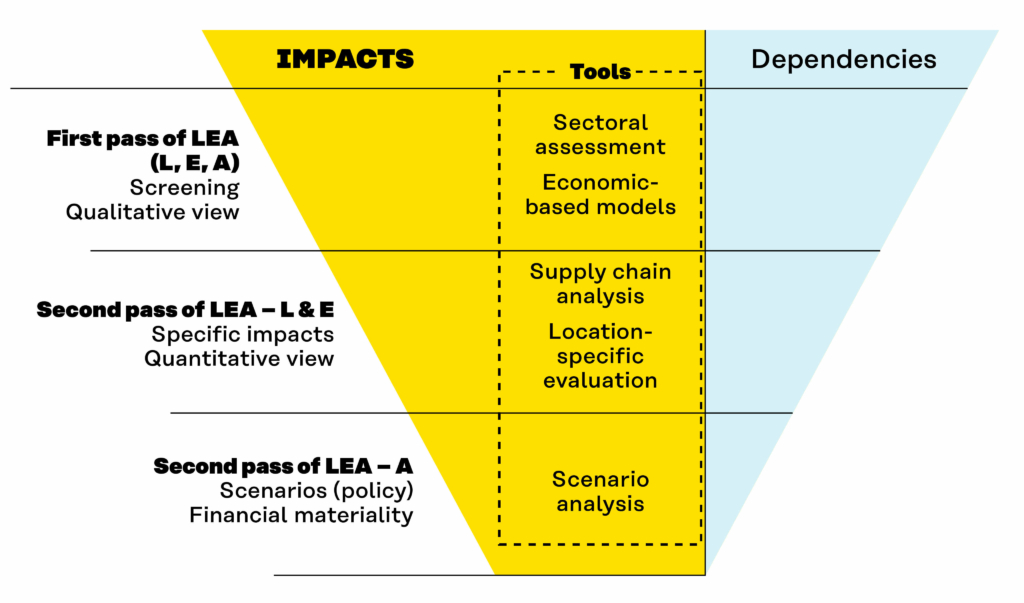

Figure 1: From LEAP passes to Action

Nonetheless, the ‘multiple passes’ concept acknowledges the need for financial institutions to prioritise most material exposures based on available evidence. For example, anticipating that water access restrictions in 3-5 locations are highly material to a significant portion of the portfolio indicates that water-related impacts need more attention within that basin.

As Figure 1 above shows, each step of analysis increases the scope for action. The first pass of LEA enables initial reporting on where the likely material impacts and dependencies are. This justifies both the development of policies for the highest impact sectors such as agriculture, and the publication of statements that acknowledge the issue of nature loss. By pinpointing where and to what extent the most material nature-related impacts and dependencies exist, the second pass of L & E then enables further internal resources to develop ambitious engagement strategies. Finally, the second pass of A can trigger capital reallocation based on quantitative estimates of financial risk and opportunity, offering the strongest justification possible for setting targets that halt and reverse nature loss.

This guidance, like the workshops upon which it was based, provides a walkthrough of the “multiple passes” and the action they help to enable. It does this by separately exploring the process for evaluating impacts (the effects of businesses on nature) and dependencies (the effects of nature on businesses) – see Key Terms for further explanation. The aim of the guidance, therefore, is to empower financial institutions to accelerate action to halt and reverse nature loss based on available tools and techniques.

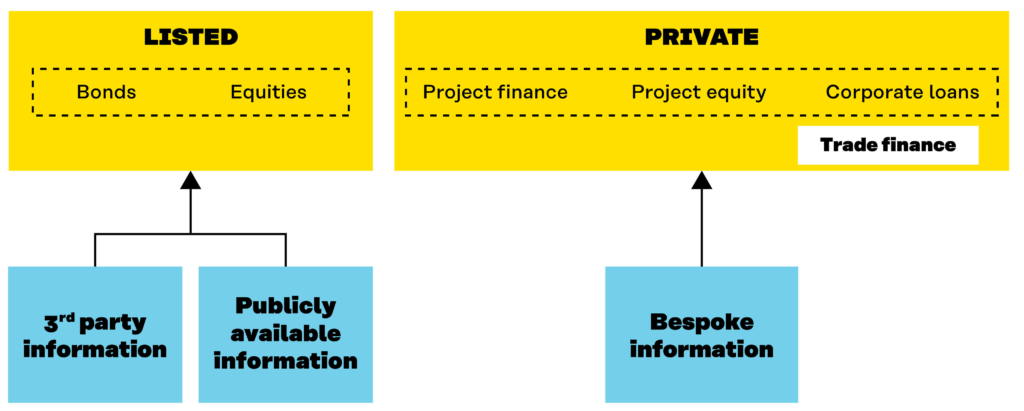

Figure 2: data availability differs by asset and finance type

2. From nature-related impacts to transition risks and opportunities

This section details how financial institutions can locate, evaluate and assess the impact of their finance on nature and the subsequent transition risks and opportunities. The LEA of dependencies will be covered in section 3.

Economic activity puts pressure on nature. Land is converted, natural resources extracted, habitats polluted, invasive species introduced, and the climate changed. These five pressures are nature-related impacts that can be avoided, mitigated, reduced and reversed. To act effectively, financial institutions must first understand what the most significant impacts are which they will have influence over.

By conducting multiple passes of LEA of the LEAP process financial institutions can prioritise the most material nature-related impacts, evaluate those impacts and assess how they may become financially material. As such, this chapter is organised into three stages:

- The first pass of ‘LEA’, which enables parts of the portfolio to be prioritised.

- The second pass of ‘L & E’, which evaluates the impact of specific locations.

- The second pass of ‘A’ that aims to indicate a financial exposure because of negative impacts caused, or likely caused, by some portfolio companies.

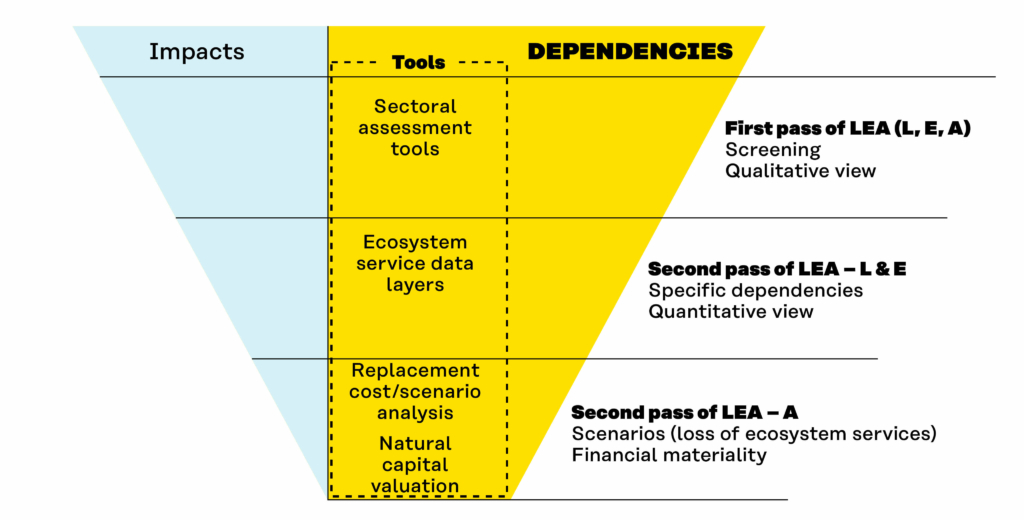

Figure 3: The passes of LEA for nature impact and types of tools that can be used (more information about tools in Table 2)

As Figure 3 above details, the first pass is about screening at the portfolio-level, whilst the latter passes integrate location-specific information and forward-looking scenarios to (1) evaluate and estimate the extent of specific impacts and (2) begin to quantify transition risk exposure. The passes of LEA are enabled by a variety of tools, summarised in Table 2 below. These tools require different amounts of input data and consequently deliver outputs that are only appropriate for certain use cases, e.g. estimating likely impacts and prioritising certain sub-sectors or assets within a portfolio for further analysis.

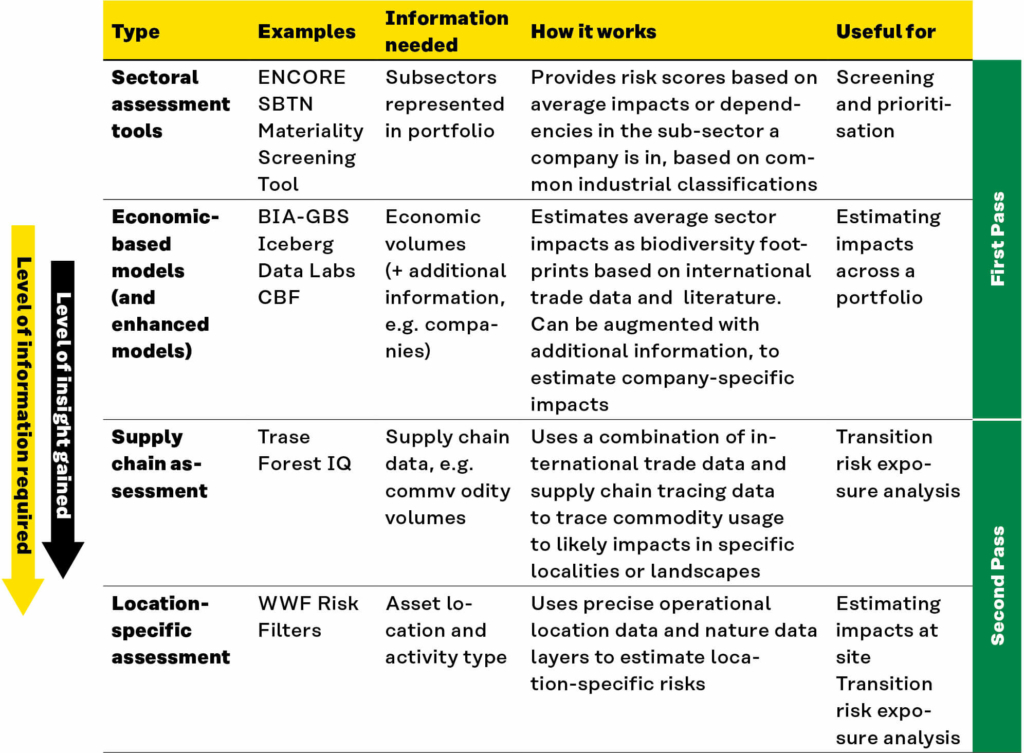

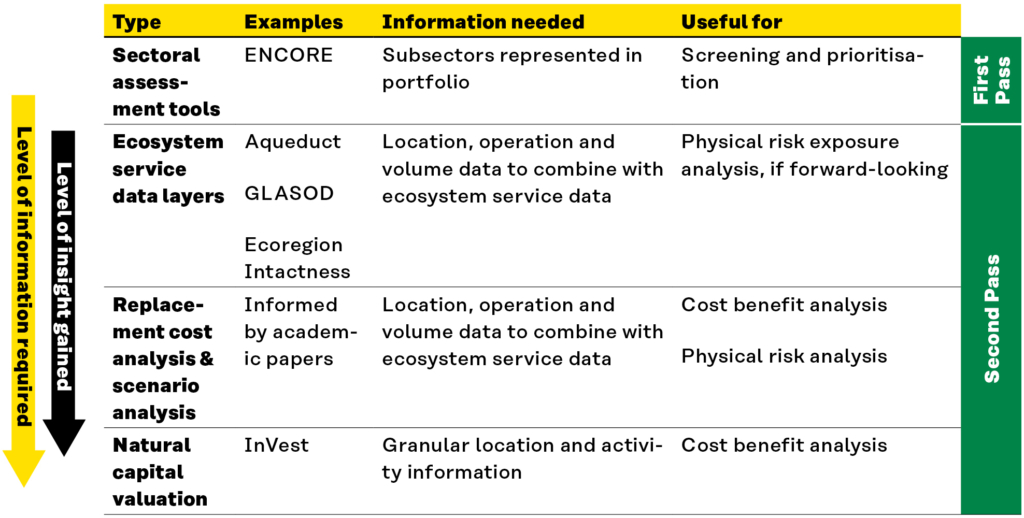

Table 2: Tools available to identify and evaluate nature-related impact and transition risk exposures

2.1 First pass of LEA: screening for nature impacts

Financial institutions can use a range of data and tools to estimate where their portfolio is likely to have a materially negative impact on nature unless managed adequately. For screening, two types of tools can be utilised without location-specific information: sectoral assessment tools and economic-based modelling (see above Table 2).

By indicating likely nature impact exposure within the portfolio, these tools enable FIs to choose which companies to prioritise for further analysis. During subsequent passes, operational or location data about a portfolio company and its assets enables granular evaluation and assessment of nature-related exposure. This data might be acquired via purchase from a 3rd-party provider or through dialogue with the company, depending on the nature of the financing relationship.

Sectoral assessment tools

These tools have low information requirements. They are based on category assessment scoring where the likely materiality of sub-sectors impacts on aspects of nature is estimated. They are precautionary, indicating a company’s likely impact materiality based on the sector it operates without considering how that individual company is avoiding or reducing its impacts. However, the tools enable evaluation and assessment of the potential impact of different companies from different sectors at a portfolio-level. By using them, a financial institution can understand where to investigate impacts in more detail.

Economic-based modelling

Economic-based modelling utilises economic data such as trade data to estimate companies’ average impacts. These impacts, sometimes referred to as biodiversity footprints, are usually expressed in units such as an area of Mean Species Abundance (MSA) lost or Potentially Disappeared Fraction of Species (PDF). These tools can be augmented and adjusted with company-level information, such as sustainability or financial reporting to provide more accurate impact estimates. Tools of this type include the Global Biodiversity Score (BIA-GBS) and Iceberg Data Labs’ Corporate Biodiversity Footprint (CBF).

In general, these tools are useful for providing further granularity in large portfolios. They provide a way to evaluate and assess the likely nature-related impact of companies and, depending on portfolio weighting, where in the portfolio the most material impacts may exist. This provides a further justification for prioritisation of the second pass of LEAP, where location- and operational-level information can be gathered to more accurately estimate and evaluate specific impacts.

2.2 Second pass of LEA: L & E for specific nature impacts

The second pass first locates and evaluates specific impacts associated with the companies or assets that were prioritised in the first pass.

The first pass will have delivered an indication of where these impacts are likely to be, based on sector averages. However, as mentioned in Box 1, location matters. To properly evaluate how an asset or operations impact nature, it is necessary to understand the location context in which the company is operating or from where it is sourcing. Locating in the second pass requires supply chain assessment and/or location and operational data about portfolio assets. For evaluation, location-specific nature datasets are also needed. Location and operational data are unlikely to be readily available without engaging with the company or purchasing from a data provider.

Supply chain assessment

Supply chain assessment tools such as Trase and Forest IQ utilise supply chain data, for example, commodity volumes, to trace the impacts of key supply chain commodities. This allows companies potentially connected to substantial nature impacts in their supply chains, and their financiers, to estimate their impact. With operational information from companies about commodities and sourcing, an increasingly accurate indication of nature impacts is possible. Figure 4 shows how the Trase model maps the risk of deforestation from soy, using export data from growing Brazilian soybeans.

Figure 4: How the Trase model functions (Trase 2022)

Location-specific evaluation

Location-specific evaluation coordinates specific assets or operational sites and assesses their proximity to nature-sensitive sites, such as protected areas or key water sources. Tools include the WWF Risk Filter suite. Location-specific evaluation allows for an increasingly accurate estimate of nature-related impact exposure by showing which assets and sites are close to sensitive locations and which are not. Therefore, it can be used to prioritise an assessment of financial materiality.

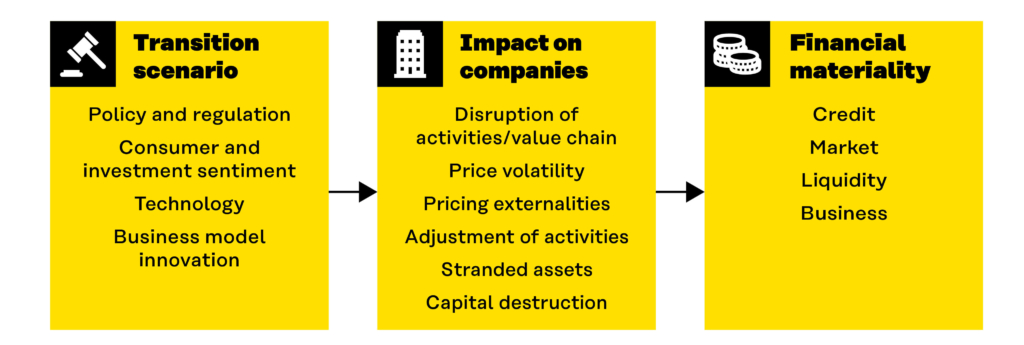

2.3 Second pass of LEA: Assessing transition risks/opportunities

Having prioritised sectors, companies and locations, FIs can develop transition scenarios to assess where the impact exposures could prove financially material as, for example, policies are implemented to reverse nature loss. Previous passes have narrowed the scope and enabled one to only develop scenarios for locations and jurisdiction where the nature impacts have been evaluated as acute.

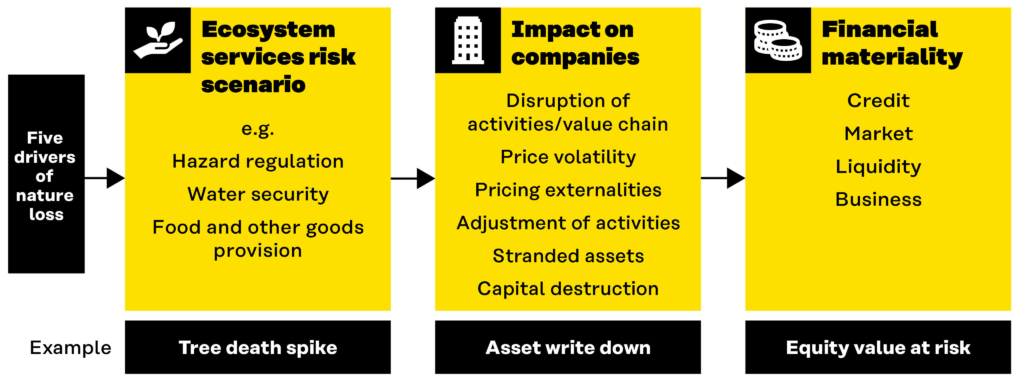

The decline of nature can provoke a response from policymakers, regulators, ultimate asset owners and civil society. These responses represent transition risks and opportunities, which impact companies and thus create a nature-related financial exposure for financial institutions (see Figure 5). Transition scenarios are used for assessing these risks and opportunities.

Figure 5: Transition scenarios and financial materiality

For further information and definitions of categories see the CISL Handbook on Nature-related Financial Risks.

Transition scenarios are often readymade, which means they are based on announced policy positions instead of hypothetical ones. For instance, this study from the Cambridge Institute for Sustainability Leadership quantifies the equity value at risk posed to fertiliser companies in investment portfolios as a result of the potential implementation of the EU Farm to Fork Strategy. A look at the Global Biodiversity Framework and how governments might implement some of the targets, such as those around subsidy reform, can represent a good starting point for transition scenario development.

2.4 Workshop exercise: from portfolio-level screening to assessment of nature-related impacts and the resultant transition risk exposure

This exercise described below is an abridged representation of what was covered in the workshops to increase familiarity with the tools and techniques involved in the different passes of LEA.

Step 1: Prioritisation using the SBTN Materiality Screening Tool

Pick two to four subsectors to evaluate for nature-related impacts at sectoral level using the SBTN Materiality Screening Tool, under the ‘Full Direct Operations Dataset’ tab. Navigate to the relevant subsector and production process, and note how many pressures it has material impacts for (a Materiality score of ‘1’). You could pick subsectors which you work with, or which are represented in your portfolio.

Prioritise the subsectors as ‘low’, ‘medium’ or ‘high’, and write down your reasons, as in Table 3 below. This should be based on the number of material impacts, and other relevant factors such as your portfolio exposure (if known). Choose one subsector to analyse further – due to the free tool used in the next section, pick a subsector with either terrestrial use, biological alterations, disturbances or water use impacts.

Table 3: Example output from Step 1

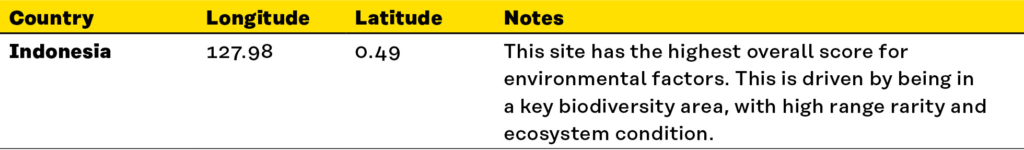

Step 2: Evaluate risk at operational locations using WWF Risk Filter

Create an account on the WWF Risk Filter. Create a ‘Company’ in the portfolio manager and add two or more operational sites to analyse for site-level impacts using either the Biodiversity or Water Risk Filter. These could be fictional or based on your knowledge of a real company. The exact location is not important – you can find coordinates using online mapping services.

You can analyse using either a map or a dashboard by clicking on details. Make notes about what is driving the overall score for each of the sites displayed, as in Table 4 below.

Table 4: Example output from Step 2

Step 3: Assess policy scenarios which would create transition risk

Based on your knowledge of the sector and your assessment of nature or water risk at the location you chose, brainstorm which real or hypothetical policy scenarios might create a transition risk relating to the site and company, and why. See Table 5 below for an example.

Table 5: Example output from Step 3

3. From nature-related dependencies to physical risks and opportunities

This section details how financial institutions can locate, evaluate and assess the dependence of their financing on nature and the subsequent physical risks and opportunities.

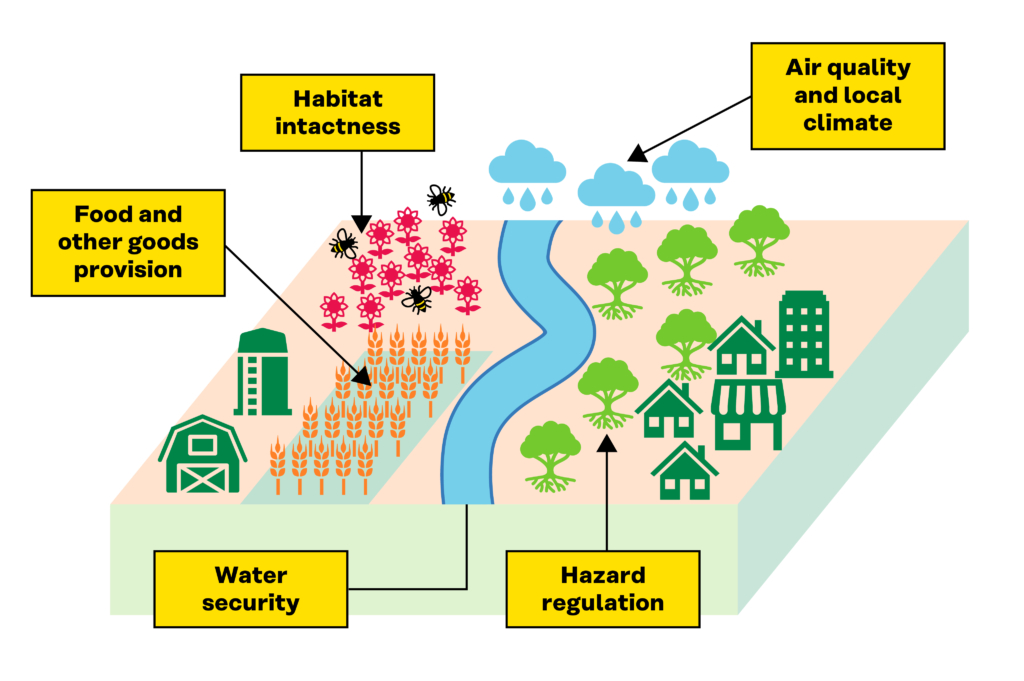

Nature provides ecosystem services upon which human activity depends, and Figure 6 below shows several categories of ecosystem service providing economic benefits across a landscape.

Figure 6: Key ecosystem services

Analysing nature dependencies is challenging because it requires data that is inefficient or impractical to obtain across all financing. Therefore, sectors and companies need to be prioritised based on their dependence and the likely financial materiality this implies. After prioritisation a physical risk and opportunities assessment – using forward-looking scenarios – can be constructed to quantify the financial materiality of dependencies. Multiple passes of LEA enable such prioritisation, as shown below in Figure 7.

Figure 7: The passes of LEA for nature dependency and physical risks and types of tools that can be used (more tools info in Table 6)

3.1 First pass of LEA: screening for nature dependencies

Financial institutions can use a range of data and tools to estimate where their portfolio is most likely to have a material dependency on nature. Screening across the portfolio with no location-specificity, sectoral assessment tools can be utilised without company-specific information (see Table 6).

Table 6: Tools available to identify, evaluate and assess nature-related dependencies and physical risk exposures

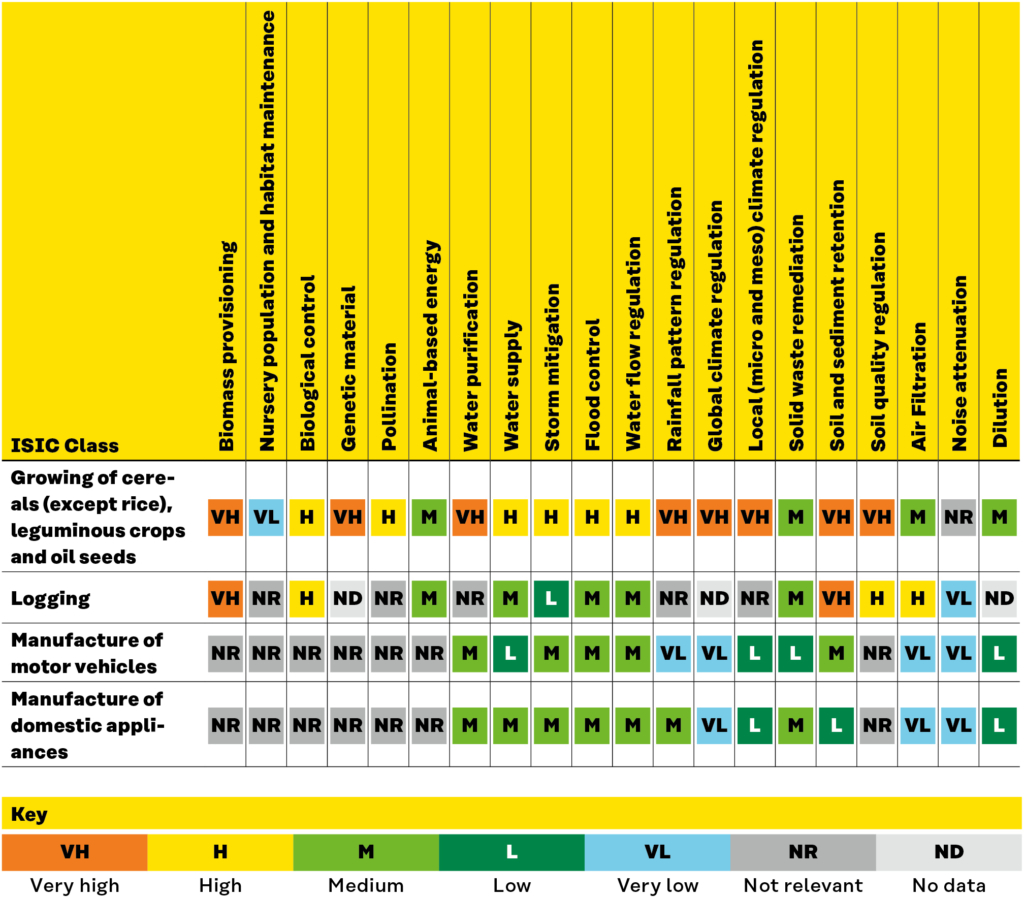

As with impacts, tools such as ENCORE can be used to indicate where high levels of dependence on specific ecosystem services likely exist by sector across a portfolio, and the materiality of that dependence. For ENCORE, each sector is given a risk score and/or a binary assessment of whether dependence is material or not.

The indicated materiality of dependence should be taken with precaution. In actuality, the dependence could be managed by the company or not exist at a given location because the availability of ecosystem services varies by location. Such tools are therefore suited for doing a first pass of LEA qualitatively across an entire portfolio of assets and flagging potential dependencies. Table 7 shows the output of the risk score from ENCORE for selected sectors.

Table 7: Example outputs of ENCORE for selected sectors and relevant ecosystem services

3.2 Second pass of LEA – L & E for specific nature dependencies

A second pass of LEA needs to become location-specific to more accurately locate and evaluate the extent of dependence and the availability of ecosystem services. Should these services fail, this enables an assessment of the potential physical risk associated with the portfolio interface with nature. An assessment of what happens should there be a failure or curtailment is the focus of the subsequent assess step of the second pass of LEA. Such evaluation of dependence and exposure to physical risk relies on ecosystem service-related data layers (see the above Table 6). These can be combined with location data and information about how assets/companies operate (e.g. consumption of water) to evaluate dependence of companies on ecosystem services using tools including Aqueduct.

3.3 Second pass of LEA – assessing physical risk/opportunities

A high-quality dependence evaluation will indicate how a company depends on specific ecosystem services in different locations and what effect their failure would have on the company. This can then be combined with an assessment of the likelihood of the loss of the ecosystem services to estimate financial exposure. This assessment of likelihood represents a scenario.

As Figure 8 shows, drivers of nature loss like climate change, pollution, overexploitation and invasive species can inhibit ecosystem services, such as pest control (a hazard regulation service). For example:

- Due to climate change and the homogenous forest structure caused by forestry practices, bark beetle infestations in forests are increasing, leading to higher rates of tree mortality.

- This impacts forestry companies’ wood supply opportunities and may, for example, cause longer transport distances and thus increase costs.

- Likewise, the revenues of associated businesses, such as logistics companies, will suffer materially if supply chains shift.

- These impacts are financially material and represent an increased credit risk to financiers.

Creating risk scenarios for ecosystem services with significant dependencies — either geographically or for a company — helps assess financial materiality.

Figure 8: The process by which drivers of nature loss are transmitted into ecosystem service degradation, impact on companies and thereby financial materiality.

Assessing a nature-related physical risk or opportunity also benefits from a replacement cost analysis; for example, replacing an ecosystem service such as pollination services for almonds. For further information and definitions of categories, see the CISL Handbook on Nature-related Financial Risks.

Combined, replacement cost and scenario analyses can then provide inputs to financial models about how the future revenues and costs of a company could be impacted should a physical risk manifest because of the degradation of ecosystem services.

Put differently, the objective of the assess stage of the second pass is to have enough evidence about:

- how an archetype or actual company will be impacted by the acute or chronic failure of an ecosystem service (based on location, operational and industry information);

- how likely the service is to fail (based on location and scientific literature).

An example of an assessment of this type is CISL and Robeco’s study ‘How soil degradation amplified financial vulnerability’. The study estimated the financial exposure of companies in the agricultural value chain if they grow crops on degraded land or source crops from such areas. It combined historical data on commodity prices and scientific literature on yields to generate a scenario about crop yield losses from areas of degraded land in Brazil following an extreme weather event. The impact of that scenario on the costs and revenues of companies along the value chain was then estimated.

These assessments of the financial materiality of nature loss are key to justifying risk management measures, including engagement, further data gather, alteration of financing or investment terms, or the creation of nature-specific teams.

3.4 Workshop exercise: from portfolio-level screening to assessment of nature-related impacts and the resultant transition risk exposure

This exercise described below is an abridged representation of what was covered in the workshops to increase familiarity with the tools and techniques involved in the different passes of LEA.

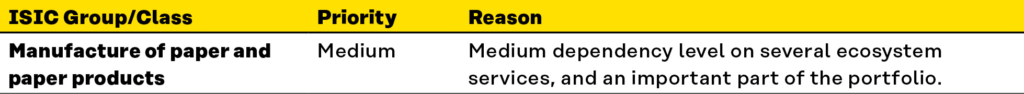

Step 1: Prioritisation using ENCORE

Pick two to four subsectors (select an ISIC Division, then ISIC Group/Class) to evaluate for dependencies at sectoral-level using ENCORE under the ‘Dependencies’ tab. Navigate to the relevant subsector, and note how many ‘Ecosystem Services’ it has dependencies on, and how high the level of these dependencies are. The choice of sectors is not important – you could pick subsectors which you work with, or which are represented in your portfolio.

Prioritise the subsectors as ‘low’, ‘medium’ or ‘high’, and write down your reasons, as in Table 8 below. This should be based on the number of dependencies and their intensity, and other relevant factors such as your portfolio exposure (if known). In preparation for Step 2, choose one subsector with dependence on Water flow regulation services, Water purification services or Water supply.

Table 8: Example output from Step 1

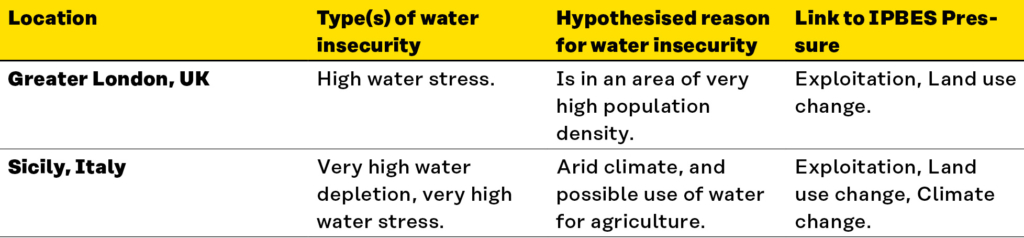

Step 2: Evaluate specific exposure using ecosystem service layers

Create at least two sites in the Aqueduct tool to evaluate for site-level dependencies using the ‘Baseline’ tab. These could be fictional or based on your knowledge of a real company. The exact location is not important – you can find coordinates using online mapping services.

Assess whether the site is in a water insecure area, based on the different data layers available in Aqueduct, hypothesising about why the area is water insecure and how this links to one of the five drivers of nature loss (Land & sea use change, Exploitation, Climate Change, Pollution, Invasive Species), and write your reasons down, as in Table 9 below.

Table 9: Example output from Step 2

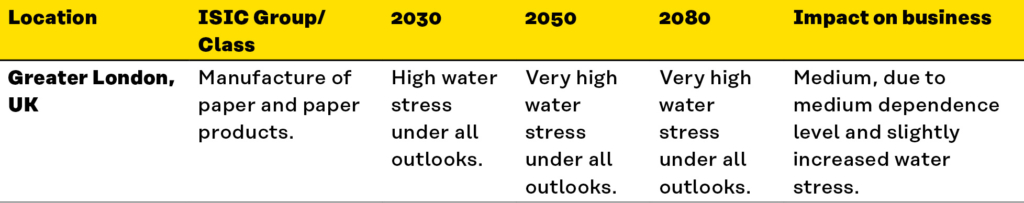

Step 3: Apply a physical risk scenario

For one or more of the sites evaluated in Aqueduct, assess whether the water insecurity faced by the site will worsen, by navigating to the ‘Future’ tab and viewing the Water Stress data layer for 2030, 2050 and 2080 under the ‘Pessimistic’ and ‘Optimistic’ outlooks. Note how water stress might change in each period and hypothesise what effect this might have on an archetype business from the subsector chosen, as in Table 10 below.

Table 10: Example output from Step 3

4. Scoping and justifying action: the value of the LEAP framework

This section explains how the LEA process supports financial institutions to mitigate nature-related risks, capitalise on opportunities and set targets on nature. They represent types of action that can fit under the ‘P’ of LEAP.

The passes of LEA described by Sections 2 and 3 can iterate the nature vision of a financial institution and inform what specific targets the institution sets – be those response, engagement, financing, or aggregated pressure targets (see Section 4.3 below). Each target should aim to manage nature-related risks and capitalise on related opportunities, as well as report against the TNFD or other frameworks.

4.1 Managing nature-related risks

Successive passes of LEA can inform and justify the management of nature-related risks via policies, company engagement and, over time, allocation decisions.

Figure 9 below visualises how the first pass of LEA narrows down the entire portfolio of financed companies and clients to those that are likely to be most exposed to nature-related dependencies, impacts, risks and opportunities (DIRO). This implies that if those companies are poorly managing their interface with nature, then the consequences of inaction, such as physical or transition risks, could be significant for them and their financiers. The second pass, by getting location specific and operational information where possible, evaluating the extent of impacts and dependencies and then the financial materiality, enables the financial institution to narrow down on only those companies with the greatest nature-related exposures.

Even the first pass justifies action. Based on the first pass, it might be identified that there are several companies in the portfolio potentially connected to deforestation. Even if the subsequent passes of LEA show that the companies are managing this exposure very well, the presence of the risk and the risks of mismanagement therefore justify the creation of deforestation position statements and commitments by the financial institution.

The second pass identifies the most material exposures. For example, an FI could trace and assess to what extent portfolio companies produce or source soft commodities from degrading soils. This enables engagement on mitigating actions, setting requirements and providing support for the company to transition the farming practices of its suppliers, and potential capital reallocation.

Figure 9: How successive passes of LEAP narrow focus and justify action

4.2 Capitalise on opportunities

Passes of LEA enhance an FI’s understanding of how its portfolio companies interface with nature through their operations and supply chain, which enables financial decisions to account for emergent vulnerabilities where key ecosystem services are at risk. From access to clean water, to the regulation of pests and diseases to the prevention of landslide – appropriate management of the services nature provides is in the interest of business and finance.

Recognising this, financial innovation seeks both to grasp opportunities and solve challenges. Some of the most creative approaches seek financial solutions to protect the provision of ecosystem services in the landscape. Examples of this include the Wyre Catchment Area SPV or the Mesoamerican Reef Insurance Programme. The Wyre Catchment Area SPV is a UK financial vehicle enabled by a bank loan from Triodos Bank, under which more than 1,000 targeted measures to prevent floods are delivered. Beneficiaries of the reduced flood risk are paying for the interventions.

Equally, opportunities exist to price in risk for portfolio companies that neither recognise their nature-related risks nor reward asset owners with products that can demonstrably benefit nature, such as sustainability-linked bonds and loans. An example of this is Brazilian paper producer Klabin, which issued a sustainability-linked bond with targets on limiting water consumption, recycling above a certain percentage of waste, and reintroducing species into its forest areas. If the targets are not met, the transaction fee increases. The LEA passes enable the identification of such innovation needs and product opportunities.

4.3 Iterate nature vision and set targets

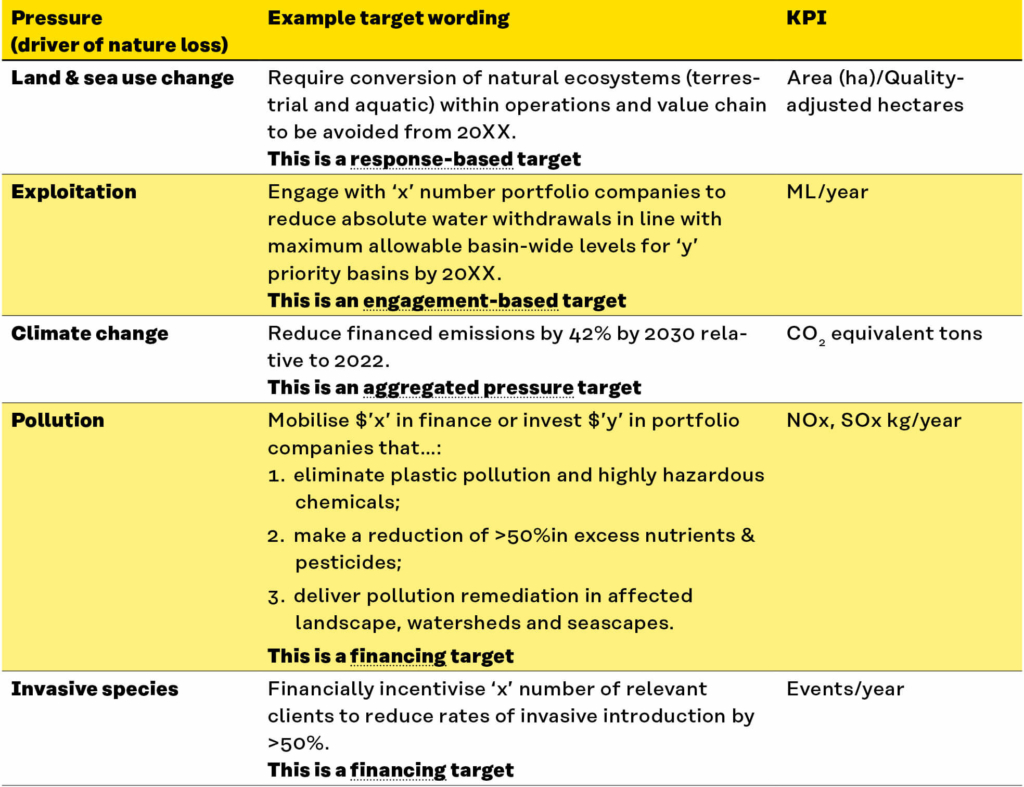

Key to the prepare stage of LEAP is target setting. This provides (1) the specific deliverables of any nature-related vision of a financial institution and (2) the goal through which the material nature-related exposures, identified during the LEA passes, are managed.

There are four prominent types of targets that could be utilised by financial institutions:

- ‘Response’ – requiring portfolio companies to respond or meet a certain target;

- ‘Engage’ – committing the FI to engage with companies on an issue;

- ‘Financing’ – committing the FI to mobilisation or allocation;

- ‘Aggregate pressure’ – committing the FI to reduce the pressure of nature across the portfolio(s) and aggregated. Reducing financed emissions across a portfolio toward net zero is an example of such a target.

As well as identifying the exposures that require management, LEA passes can inform the target and key performance indicator (KPI) selection by providing the baseline measurement for the target and an appreciation of how viable it will be to measure and achieve the targets. Table 11 below provides examples of these targets and KPIs.

Table 11. Example nature-related targets and KPIs for financial institutions

Whilst financial institutions can theoretically set these targets now, the passes of LEA enable efforts to manage risk (see Section 4.1) and scope opportunities (see Section 4.2) to be prioritised, and to ensure that any targets are (a) aligned with portfolio exposures, (b) realistic and (c) ambitious.

Call to action

Nature is in crisis. Companies must reorient their activities to avoid and reduce harm and promote recovery. This requires leadership and support from financial institutions, which means they must understand how their portfolio companies impact nature and are put at risk as nature degrades.

However, the ability of FIs to access and analyse information to develop this understanding of the relationship between finance and nature – and justify action to positively evolve that relationship – represents a significant challenge. To address this challenge, this report details an approach that FIs can use to understand how their finance is connected to nature, utilising the TNFD-LEAP approach. The method, represented as multiple passes of the LEAP approach, delivers insights that can prioritise action and support the integration of nature into financial decision making. It details how, even with limited information, tools and approaches are available to start, and that, as the connection between finance and nature becomes better understood, specific data and analysis can be justified and prioritised. Through such analysis, ambitious, targeted action by individual financial institutions to halt and reverse nature loss is possible, supporting urgently needed action amongst corporates and helping to catalyse similar ambition across the financial sector.

Key terms

DIRO

Impacts

“Changes in the state of nature (quality or quantity), which may result in changes to the capacity of nature to provide social and economic functions. Impacts can be positive or negative. They can be the result of an organisation’s or another party’s actions and can be direct, indirect or cumulative. A single impact driver may be associated with multiple impacts. Positive or negative changes in the natural world as a result of human activity”. (TNFD 2023b, p.32)

Dependencies

“Dependencies are aspects of environmental assets and ecosystem services that a person or an organisation relies on to function. A company’s business model, for example, may be dependent on the ecosystem services of water flow, water quality regulation and the regulation of hazards like fires and floods; provision of suitable habitat for pollinators, who in turn provide a service directly to economies; and carbon sequestration”. (TNFD 2023b, p.17)

Transition risks

“Regulatory or market efforts to address environmental harm can negatively impact companies and lead to stranded assets – representing ‘transition risks’. These can include abrupt or disorderly introduction of public policies, technological changes, shifts in consumer or investor sentiment and disruptive business model innovation. As such they “relate to [a] process of adjustment” towards a nature-positive economy. For example, anti-deforestation legislation increases due diligence costs for buyers of soft commodities that could be connected to deforestation.” (CISL 2021, p.7)

Physical risks

“Much of global economic enterprise depends on the good functioning of natural systems, such as stability of climate and generation of raw materials. Physical risks arise when these natural systems are compromised, due to the impact of climatic (i.e. extremes of weather) or geologic (i.e. seismic) events or widespread changes in ecosystem equilibria, such as soil quality or marine ecology. Physical risks can be event-driven or longer-term in nature. It is the damage to ecosystem equilibria and resulting ecosystem service degradation that is our focus. For example, deforestation could reduce local rainfall, raising operating costs for numerous sectors.” (CISL 2021, p.7)

TNFD stages

Locate (TNFD)

“Locate your interface with nature.” (TNFD 2023a, p.3)

Evaluate (TNFD)

“Evaluate your dependencies and impacts on nature.” (TNFD 2023a, p.3)

Assess (TNFD)

“Assess your nature-related risks and opportunities.” (TNFD 2023a, p.3)

Prepare (TNFD)

“Prepare to respond to, and report on, material nature-related issues, aligned with the TNFD’s recommended disclosures.” (TNFD 2023a, p.3)

References

Carbon4Finance. 2024. Global Biodiversity Score (BIA-GBS). (retrieved 19 November 2024)

CBD. 2022. 2030 Targets. (retrieved 19 November 2024)

CISL. 2021. Handbook for Nature-related Financial Risks. (retrieved 19 November 2024)

CISL & Robeco. 2022. How soil degradation amplified financial vulnerability. (retrieved 19 November 2024)

ENCORE. 2024. ENCORE (Exploring Natural Capital Opportunities, Risks and Exposure). (retrieved 19 November 2024)

EU. 2022. Corporate Sustainability Reporting Direction (CSRD). (retrieved 19 November 2024)

EU. 2024. Sustainable Finance Disclosure Regulations (SFDR). (retrieved 19 November 2024)

Forest IQ. 2024. Forest IQ. (retrieved 19 November 2024)

Green Finance Institute. 2022. The Wyre Catchment Natural Flood Management Project. (retrieved 19 November 2024)

Klabin. 2021. Klabin issues 10-year sustainability-linked bond for US$ 500 million. (retrieved 19 November 2024)

Iceberg Data Lab. 2024. Corporate Biodiversity Footprint (CBF). (retrieved 19 November 2024)

Marfund. 2020. Mesoamerican Reef Insurance Programme. (retrieved 19 November 2024)

SBTN. 2024. Materiality Screening Tool. (retrieved 19 November 2024)

TNFD. 2024a. Additional Guidance by Sector. (retrieved 19 November 2024)

TNFD. 2024b. Glossary. (retrieved 19 November 2024)

TNFD. 2024c. Guidance on Scenario Analysis. (retrieved 19 November 2024)

TNFD. 2023. Guidance on the identification and assessment of nature-related issues: the LEAP approach. (retrieved 19 November 2024)

Trase. 2022. Connecting exports of Brazilian soy to deforestation. (retrieved 19 November 2024)

Trase. 2024. Trase. (retrieved 19 November 2024)

UK Government. 2021. Final Report – The Economics of Biodiversity: The Dasgupta Review. (retrieved 19 November 2024)

UNEP. 2023. State of Finance for Nature. (retrieved 19 November 2024)

World Resources Institute. 2024. Aqueduct Water Risk Atlas. (retrieved 19 November 2024)

WWF. 2024. WWF Risk Filter Suite v2.0. (retrieved 19 November 2024)